Strategies for Paying Off Debt: Snowball vs. Avalanche Method

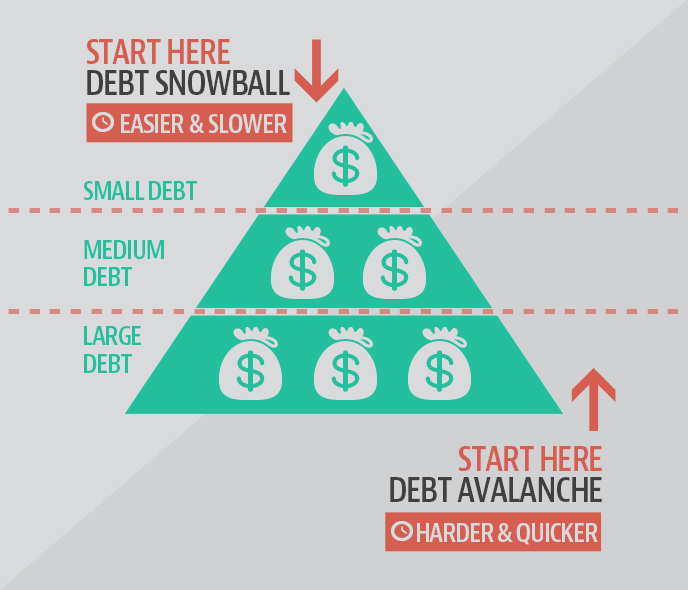

Debt can feel overwhelming, but with the right strategy, you can take control of your finances and work towards a debt-free future. Two popular methods for paying off debt are the snowball method and the avalanche method. Let’s explore each approach to help you decide which one is best for you.

1. The Snowball Method

How It Works

The snowball method involves paying off your debts in order from smallest to largest, regardless of interest rates. You make minimum payments on all debts except the smallest one, which you attack with extra payments until it's paid off. Once the smallest debt is cleared, you move on to the next smallest debt, and so on.

Benefits:

- Quick Wins: Paying off smaller debts first provides a psychological boost and motivates you to tackle larger debts.

- Simplicity: The snowball method is straightforward and easy to understand, making it accessible for those new to debt repayment strategies.

- Momentum: As each debt is paid off, you free up more money to put towards the next debt, building momentum towards your ultimate goal of debt freedom.

2. The Avalanche Method

How It Works

The avalanche method focuses on paying off debts with the highest interest rates first while making minimum payments on the rest. Once the debt with the highest interest rate is paid off, you move on to the next highest, and so forth, until all debts are cleared.

Benefits:

- Cost Savings: By prioritizing high-interest debts, you save money on interest payments over time, potentially paying less overall.

- Efficiency: The avalanche method targets debts strategically, minimizing the total amount paid and reducing the time needed to become debt-free.

- Financial Discipline: This method encourages disciplined financial behavior by prioritizing debts based on their financial impact rather than their size.

Choosing the Right Method for You

Consider Your Financial Situation

Snowball Method: Ideal for individuals who need motivation and momentum to stay on track with debt repayment. It's particularly effective for those with multiple smaller debts.

Avalanche Method: Suited for individuals who are focused on minimizing interest costs and have the discipline to stick to a strategic repayment plan. It's beneficial for those with high-interest debts, such as credit cards.

Assess Your Personality and Motivation

Snowball Method: If you find motivation in quick wins and visible progress, the snowball method may be more appealing.

Avalanche Method: If you're motivated by financial efficiency and are willing to prioritize long-term savings over immediate gratification, the avalanche method may be a better fit.

Evaluate Your Debt Portfolio

Interest Rates: If you have high-interest debts, such as credit cards or payday loans, the avalanche method can save you more money in the long run.

Number of Debts: If you have numerous smaller debts, the snowball method can help you simplify your repayment strategy and stay motivated.

Both the snowball and avalanche methods are effective strategies for paying off debt. The key is to choose the method that aligns best with your financial goals, personality, and debt profile. Whether you prefer the quick wins of the snowball method or the long-term savings of the avalanche method, committing to a debt repayment plan and staying disciplined will set you on the path to financial freedom. Remember, the most important step is taking action and starting your journey towards a debt-free life.