Resources for Learning About Personal Finance: Books, Podcasts, Websites, and More

Personal finance is a critical life skill that affects every part of your future, from managing debt and building wealth to saving for retirement and reaching your financial goals. Whether you're just starting out or looking to refine your skills, there are plenty of resources available to help you on your financial journey. Below, we’ll dive into the best books, podcasts, websites, and tools to guide you toward financial literacy.

Books: Timeless Guides to Personal Finance

Books on personal finance provide in-depth knowledge and long-term strategies to help you develop a solid financial foundation. Here are some must-reads for anyone looking to master their money:

-

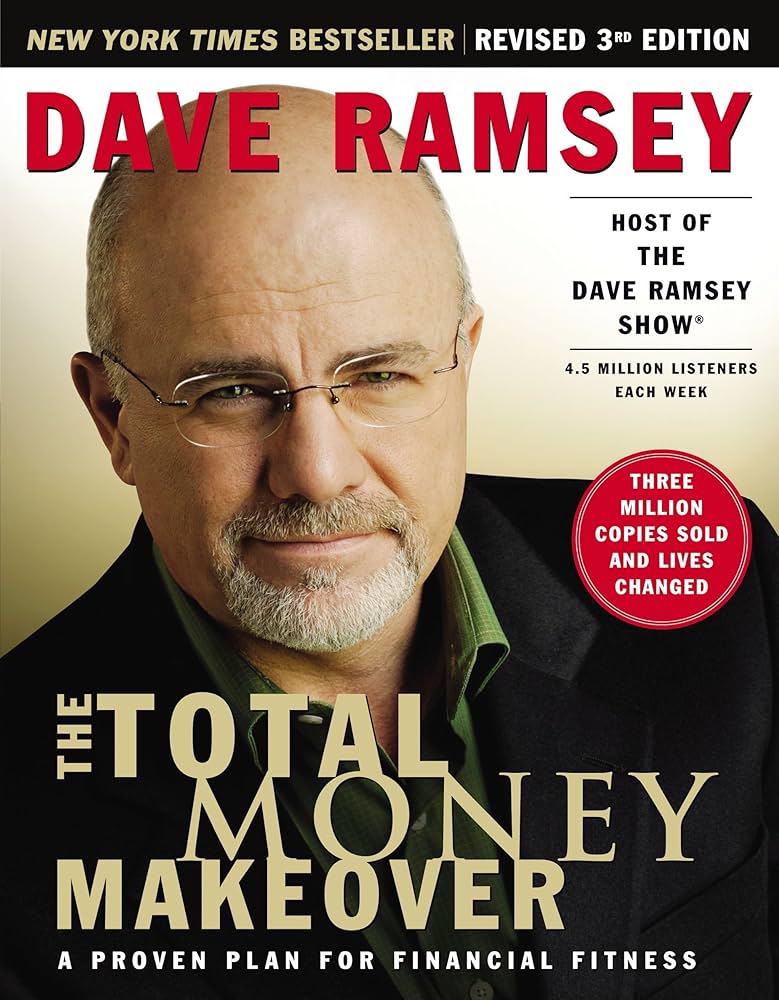

"The Total Money Makeover" by Dave Ramsey

A step-by-step plan to pay off debt, build savings, and achieve financial freedom. Dave Ramsey’s approach is straightforward and focuses on living below your means and avoiding debt. It’s a classic for people serious about transforming their financial habits. -

"Rich Dad Poor Dad" by Robert Kiyosaki

This book contrasts the financial mindsets of Kiyosaki’s two father figures—one rich and one poor. It teaches the importance of financial education, investing, and thinking outside the box when it comes to wealth building. -

"Your Money or Your Life" by Vicki Robin and Joe Dominguez

A transformative guide that helps you understand the relationship between your time, money, and happiness. This book advocates for financial independence and rethinking the way you earn, save, and spend money.

-

"The Simple Path to Wealth" by JL Collins

A great resource for beginner investors, this book breaks down complex financial concepts into easily digestible advice. Collins discusses the importance of index funds, investing for the long term, and achieving financial independence. -

"I Will Teach You to Be Rich" by Ramit Sethi

Written in an engaging, humorous tone, this book offers actionable steps to automate your finances, crush debt, and make smart money decisions without giving up on the things you enjoy.

Podcasts: Personal Finance on the Go

If you’re a podcast fan, there are plenty of shows that deliver excellent financial advice while keeping things entertaining and easy to follow.

-

"The Dave Ramsey Show"

This popular show is perfect for anyone wanting to get out of debt or achieve financial peace. Listeners call in with their questions, and Ramsey offers practical advice for paying off debt, saving for retirement, and making smart spending choices. -

"Afford Anything" by Paula Pant

Paula Pant dives deep into the philosophy that you can afford anything but not everything. The show covers a wide range of financial topics, including real estate investing, lifestyle design, and managing your finances in a way that supports your personal values.

- "ChooseFI"

Focused on the Financial Independence, Retire Early (FIRE) movement, "ChooseFI" shares stories, tips, and strategies to achieve financial independence. It’s ideal for anyone wanting to save more, invest smarter, and retire early. -

"The Stacking Benjamins Show"

This lighthearted, magazine-style podcast brings together expert interviews, listener questions, and financial news in a fun and easy-to-understand format. It covers a wide variety of financial topics with a humorous twist. -

"BiggerPockets Money Podcast"

Perfect for those interested in real estate, investing, and growing their net worth, the "BiggerPockets Money Podcast" provides actionable advice on building wealth, cutting expenses, and achieving financial freedom.

Websites and Blogs: Daily Insights and Tools

The internet is full of valuable websites that offer free advice, budgeting tools, and tips for improving your financial health.

-

NerdWallet

A comprehensive resource for comparing credit cards, loans, savings accounts, and more. NerdWallet also offers insightful articles on budgeting, investing, and saving for retirement. -

The Balance

The Balance covers a broad range of personal finance topics, from investing and retirement planning to debt management and budgeting. It’s an excellent site for beginners who want to build a strong foundation in financial literacy. -

Mr. Money Mustache

Written by a former software engineer who retired in his 30s, this blog is all about frugal living and achieving financial independence. It focuses on cutting unnecessary expenses and optimizing savings.

-

Mint

Mint is not only a fantastic budgeting tool but also an educational resource. The website offers articles on saving, budgeting, investing, and managing your credit. Their free app helps you track your spending and savings goals in real time. -

Investopedia

Known as the go-to for financial definitions, Investopedia also has a wealth of articles and tutorials covering everything from basic budgeting to advanced investment strategies. -

Fidelity Learning Center

Fidelity’s online learning center is packed with resources to help you understand investing, retirement planning, and portfolio management. It’s a great place for anyone new to investing or looking to learn how to manage their retirement accounts.

YouTube Channels: Visual Learning for Personal Finance

For those who prefer visual learning, YouTube channels provide an engaging way to absorb financial concepts and strategies.

-

Graham Stephan

A real estate investor and financial advisor, Graham Stephan’s channel is packed with advice on investing, saving, and creating wealth. His videos are easy to follow and filled with personal anecdotes that make financial education approachable. -

The Financial Diet

Aimed at millennials, this channel covers all aspects of personal finance, including budgeting, saving, career advice, and financial planning. It offers candid advice with a focus on practical steps. -

Andrei Jikh

Andrei Jikh’s channel combines financial education with entertainment, breaking down investing, saving, and money management in a fun, engaging style.

Apps and Tools: Automate and Track Your Finances

-

YNAB (You Need A Budget)

YNAB is a highly recommended budgeting tool that helps you assign every dollar a job. It’s great for people looking to take control of their finances and pay off debt. -

Acorns

Acorns rounds up your purchases and automatically invests the spare change, making it an easy way for beginners to start investing. -

Personal Capital

This app provides free tools for managing your investments and retirement savings. It’s a great resource for tracking your net worth and financial growth. -

Digit

Digit automates your savings by analyzing your spending habits and moving small amounts of money into savings, helping you grow your nest egg without even thinking about it.

Take Control of Your Financial Future

Learning about personal finance can be empowering, and with the abundance of resources available today, there’s no excuse not to start. Whether you prefer books, podcasts, or apps, find the resources that work for you and start building a solid foundation for your financial future.