The 50/30/20 Rule Revisited: Does It Still Work in 2025?

The 50/30/20 rule has long been a popular guide for budgeting, helping people manage their money by splitting income into needs, wants, and savings. But with rising living costs, high rent, and shifting work patterns in 2025, many are asking: Does the 50/30/20 rule still work?

Here’s what you need to know.

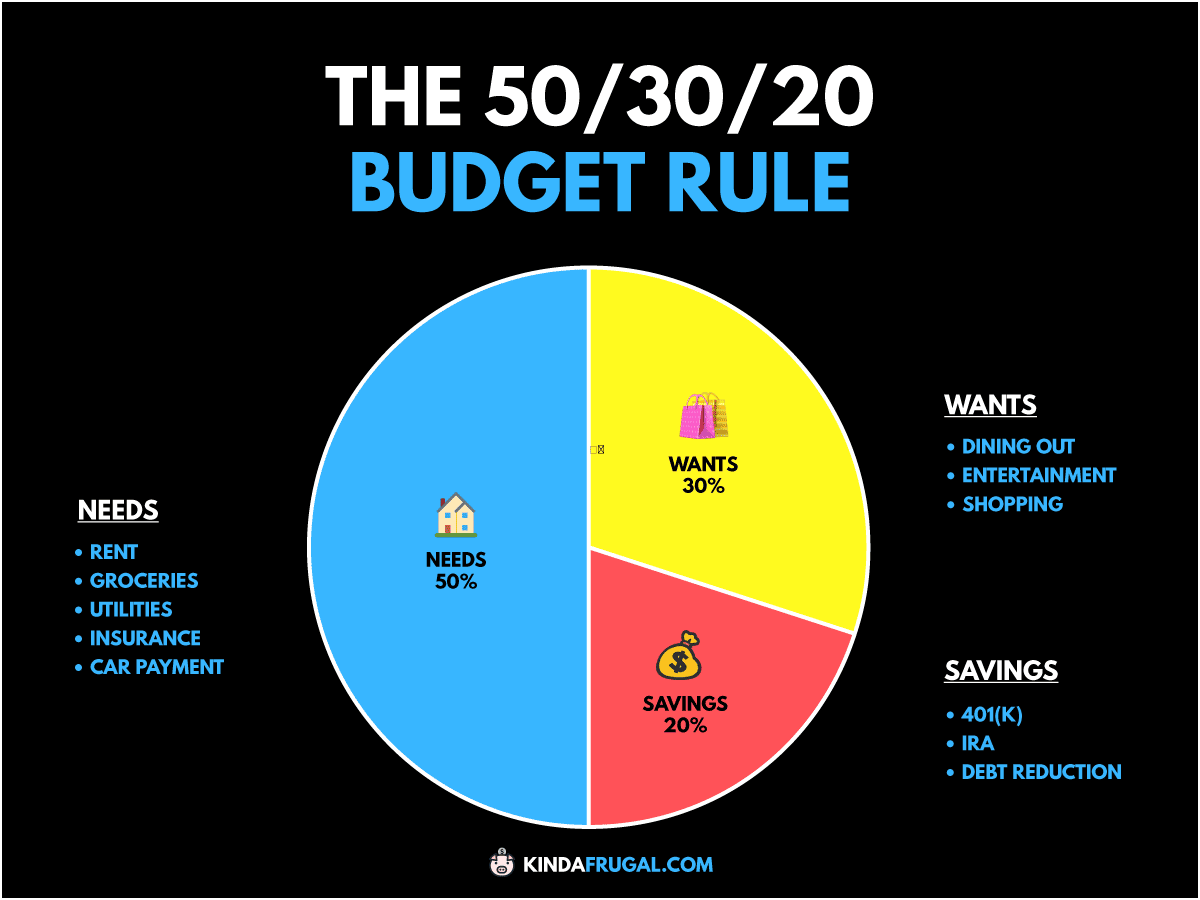

What Is the 50/30/20 Rule?

The rule suggests dividing your after-tax income into:

- 50% for needs (housing, groceries, bills)

- 30% for wants (dining out, entertainment, hobbies)

- 20% for savings and debt repayment

This method keeps budgeting simple while ensuring you save for the future.

Why People Are Questioning It Now

In 2025, many are facing:

- Higher housing and food costs, making “needs” take up more than 50%.

- Student loans and credit card debt, pushing people to prioritize debt over “wants.”

- Gig work and irregular income, making fixed percentages hard to follow.

These shifts have led many to feel the rule is outdated.

Does It Still Work?

Yes, but with flexibility.

The principles behind the 50/30/20 rule still help build financial discipline:

- Spend less than you earn.

- Save regularly.

- Separate wants from needs.

However, sticking to these exact percentages may not work for everyone today.

Adjusting the Rule for 2025

If the standard breakdown feels impossible, try these practical adjustments:

1. Adjust Based on Your Reality

- If your rent is high, you may need 60% for needs and reduce “wants” to 20%.

- If you have debt, prioritize getting to 20% or more for savings and debt payments.

2. Track Before You Split

Spend a month tracking every expense to see where your money actually goes before forcing categories.

3. Prioritize Savings

Even if you can’t save 20%, start with what you can and build up slowly. Saving something is better than nothing.

4. Build an Emergency Fund First

Before focusing on “wants,” prioritize an emergency fund that covers 3–6 months of expenses, especially if your income is unstable.

What Financial Experts Are Saying

Financial planners in 2025 still recommend the 50/30/20 framework as a starting point, but many suggest:

- Using it as a guideline, not a strict rule.

- Focusing on your unique income and cost of living.

- Adjusting the “wants” category to free up more for savings or debt payoff during tight months.

Alternatives to the 50/30/20 Rule

If the structure doesn’t fit your life, consider:

- Zero-Based Budgeting: Every dollar has a job, giving more control over where your money goes.

- 80/20 Rule: Spend 80% of income and save 20%, simplifying categories further.

- 60% Solution: Allocate 60% for committed expenses, leaving 40% for savings and flexible spending.

These methods may suit your situation better while helping you build financial discipline.

Final Thoughts

The 50/30/20 rule is not dead in 2025—but it requires flexibility. Rising costs and changing income patterns mean you may need to adjust your percentages, but the core idea of balancing needs, wants, and savings remains valuable.

Use it as a framework to understand your spending, then customize it to match your goals and current reality. Remember, the best budget is one you can consistently follow, helping you live today while building security for tomorrow.