Budgeting Tools and Apps to Manage Your Finances

Managing your finances can sometimes feel overwhelming, but the right budgeting tools and apps can simplify the process. Whether you’re looking to track your spending, save for a goal, or manage debt, these tools can help you gain control of your money and work towards financial security. Here’s a guide to some of the best budgeting tools and apps available.

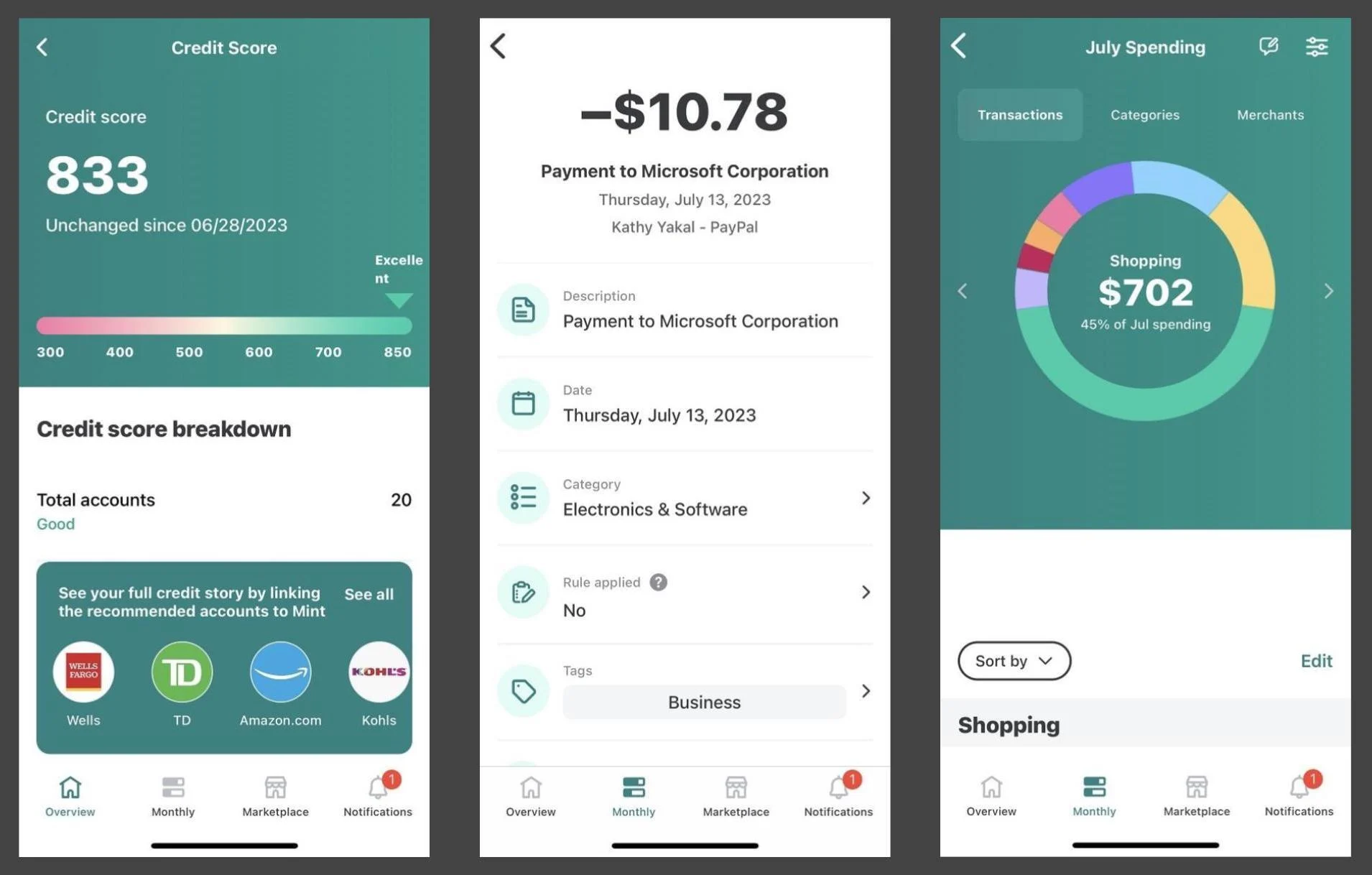

1. Mint: The All-in-One Finance Tracker

Overview

Mint is one of the most popular free budgeting apps. It links to your bank accounts, credit cards, and bills to track all your financial transactions in one place.

Key Features

-

Automatic categorization of expenses (e.g., groceries, utilities, entertainment).

-

Customizable budget setting and goal tracking.

-

Alerts for bill payments and budget limits.

-

Credit score monitoring.

Why It’s Great

Mint’s user-friendly interface and automatic syncing make it ideal for people who want a hands-off approach to tracking finances. It’s free and offers plenty of features to help manage both short-term and long-term goals.

2. YNAB (You Need A Budget): For Goal-Oriented Budgeting

Overview

YNAB is a paid app that focuses on giving every dollar a job. It’s a great tool for those who want to become more intentional with their money and save for specific goals.

Key Features

-

Zero-based budgeting method (every dollar is assigned a specific purpose).

-

Goal-setting for things like savings, debt repayment, or large purchases.

-

Detailed reports and charts to track progress.

-

Real-time syncing between devices.

Why It’s Great

YNAB is perfect for users who need more structure and are serious about budgeting. It’s especially helpful for people who want to save for a specific purpose or pay off debt. While it has a subscription fee, many users find it invaluable in helping them stick to a budget.

3. PocketGuard: Simplified Budgeting

Overview

PocketGuard focuses on simplifying budgeting by showing you how much disposable income you have after accounting for bills, goals, and necessities.

Key Features

-

Automatic categorization of spending.

-

“In My Pocket” feature that shows how much money you have available after essentials are accounted for.

-

Bill tracking to ensure you never miss a payment.

-

Easy integration with most bank accounts.

Why It’s Great

If you want a simple, no-fuss budgeting app, PocketGuard makes managing your finances easy. It’s great for users who need help seeing how much they can safely spend without compromising essential payments and savings goals.

4. EveryDollar: Streamlined Budgeting for Beginners

Overview

EveryDollar is a budgeting app created by financial expert Dave Ramsey. It’s designed for users who want to implement the zero-based budgeting method, but with a simpler, more user-friendly approach.

Key Features

-

Tracks income and expenses easily.

-

Customizable categories for spending and savings.

-

Integrates with your bank account (available with the paid version).

-

Debt-snowball feature for those who are focusing on paying off debt.

Why It’s Great

EveryDollar is a great choice for beginners who want to get started with budgeting. It’s intuitive, easy to use, and follows a simple method that’s effective for controlling spending and saving. The free version is basic, while the paid version gives you added features, including bank account syncing.

5. GoodBudget: Envelope Budgeting System

Overview

GoodBudget is a digital version of the traditional envelope budgeting system. You allocate funds into virtual “envelopes” for specific categories, helping you control spending.

Key Features

-

Envelope system for budgeting your spending categories.

-

Tracks both cash and card transactions.

-

Syncs across multiple devices, so family members or roommates can share the same budget.

-

Set savings goals and track your progress.

Why It’s Great

GoodBudget is perfect for people who prefer the envelope system but want the convenience of a digital app. It’s easy to use and offers a visual way of seeing where your money is going. Plus, it’s free with the option to upgrade for more envelopes and features.

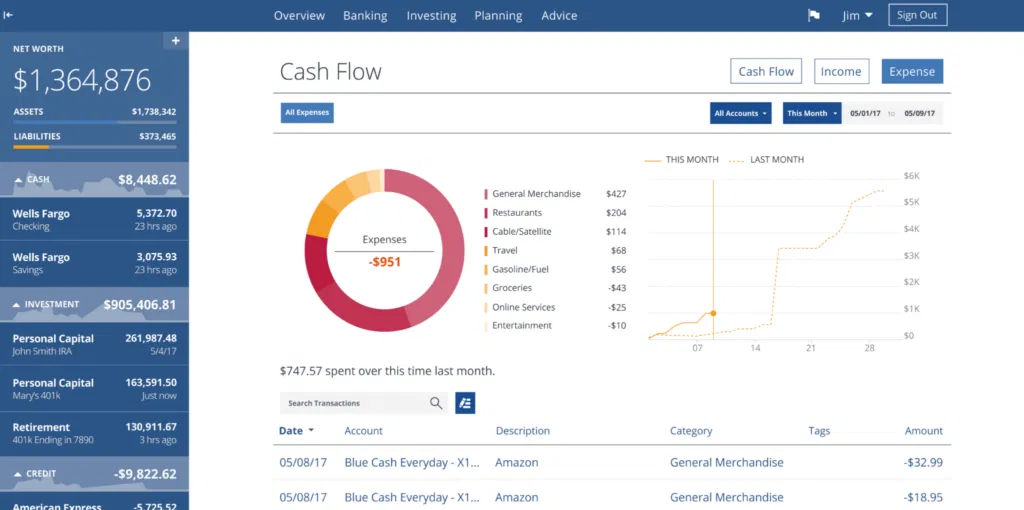

6. Personal Capital: Track Your Net Worth

Overview

Personal Capital is more of an investment and wealth management tool than a traditional budgeting app. However, it offers budgeting features that can help you track both your spending and investments.

Key Features

-

Tracks investments, retirement accounts, and assets in addition to income and expenses.

-

Net worth tracker that provides a full picture of your financial health.

-

Spending and cash flow tracking.

-

Tools to plan for retirement.

Why It’s Great

Personal Capital is perfect for people who want to keep an eye on their overall financial picture, including their investments. It’s a great tool for budgeting as well as planning for long-term goals like retirement.

7. Honeydue: Budgeting for Couples

Overview

Honeydue is a budgeting app designed specifically for couples. It helps partners keep track of shared expenses, bills, and savings goals.

Key Features

-

Track joint and individual expenses.

-

Set up shared financial goals, like saving for a vacation or paying off debt.

-

Bill reminders so that both partners stay on top of payments.

-

Synchronize bank accounts, credit cards, and loans.

Why It’s Great

Honeydue makes it easier for couples to communicate and stay on the same page when it comes to finances. Whether you’re managing a household budget or saving for a future goal, this app is built to make shared finances simpler.

Conclusion

Choosing the right budgeting tool depends on your financial goals and preferences. Whether you need a simple tracker like Mint or are focused on more structured budgeting with YNAB, there’s an app for every need. By using one of these budgeting tools, you can take control of your finances, reduce financial stress, and work toward your money goals with confidence.